Prospects of Life Assurance in the West African Landscape

What is Life Assurance?

Life insurance is a contract between an insurer and a

policyholder in which the insurer guarantees payment of a death benefit to

named beneficiaries upon the death of the insured. Thus the insurance company

promises to pay an individual’s beneficiary a specific amount of money when he

or she dies in exchange for periodic payment of premiums.

Some general benefits of Life Assurance include

Ø Pay one’s family

back for funeral costs

Ø Help pay mortgage

and other financial obligations that a person might leave behind

Ø Provide income for

the individual’s spouse

Ø Cover other extra

expenses the person’s family might have.

Types of Life Assurance

There are generally two types of Life Assurance

Products; Term Life Insurance and Permanent Life Insurance. Permanent Life

Insurance can be further subdivided into Universal Life and Whole Life

Insurance.

1. Term life insurance – under this policy, the individual

purchases a basic term life insurance for a set period, say 20 years, and the

insurer pays a lump sum to his or her beneficiaries should he or she die when

the policy is in force. This policy becomes less and less expensive across the

duration of the policy.

Term life insurance proceeds can be used to replace

lost potential income during working years. This can provide a safety net for

beneficiaries and can also help ensure the family's financial goals will still

be met—goals like paying off a mortgage, keeping a business running, and paying

for college.

2. Universal life

insurance - Universal life insurance is a type of permanent life

insurance designed to provide lifetime coverage. Universal life insurance

policies are flexible and may allow one to raise or lower premium payment or

coverage amounts throughout the lifetime. Additionally, due to its lifetime

coverage, universal life typically has higher premium payments than term.

Universal life insurance is most often used as part of

a flexible estate planning strategy to help preserve wealth to be transferred

to beneficiaries. Another common use is long term income replacement, where the

need extends beyond working years. Some universal life insurance product

designs focus on providing both death benefit coverage and building cash value

while others focus on providing guaranteed death benefit coverage.

3. Whole life insurance – Whole life insurance is designed to provide lifetime coverage. Because

of the lifetime coverage period, whole life usually has higher premium payments

than term life. Policy premium payments are typically fixed, and, unlike term,

whole life has a cash value, which builds up over time and functions as a

savings component and may accumulate tax-deferred over time.

Practical uses

of Life Insurance

A. Resource mobilisation for economic growth

Development of insurance markets is

strongly associated with economic development. This is because life insurance

is an important driver of domestic resource mobilisation for long- term

investment, which is a critical goal in sub-Saharan Africa where lack of

capital for long-term investment is constraining economic growth.

Life insurance entails long-term and

contractual savings by households. These are channeled into stable, long-term

investments by insurance providers. This means that the development of life

insurance markets is an important element in domestic resource mobilisation.

In addition to these direct effects

on domestic resource mobilization, life insurance also contributes to - and benefits

from - broader financial sector development. This includes encouraging the

deepening of banking, capital markets and regulation.

B. Employment creation

Life insurance offers important

direct benefits at the microeconomic level. Key amongst these is that it

creates employment. Direct employment created includes high-skill, high-wage

employment. This includes in finance and business support services such as the

actuarial, accounting, consulting and legal professions.

C. Household Welfare

Sub-Saharan African households are

vulnerable to shocks. This vulnerability can limit their willingness and

ability to take risks in the long and short term and lead to coping strategies

that are detrimental to their long-term welfare. This includes withdrawing

children from school, selling assets, incurring excessive debt and reducing

nutrition. Such responses to shocks - and the risk of shocks that can create

risk aversion - undermine microeconomic behaviors that lead to economic growth.

Life insurance can help reduce

household vulnerability through three specific paths, namely by facilitating

formal savings, insuring against shocks and by complementing public welfare

provision.

Facilitating formal savings

Savings by households are currently

constrained in West Africa by income and access to formal financial services. Currently,

households in the West African zone do save, but do so outside of the formal

banking system. Informal savings clubs are more common than formal savings

accounts, with 100 million adults using them in sub-Saharan Africa and 34% of

savers making only informal savings.

Life Insurance helps to bring

savings within the formal financial sector. It does this by providing a formal

contractual vehicle for long-term savings by households. This establishes

saving as a long- term habit and reinforces for households the security brought

by accumulating savings.

Life insurance products have also

been designed such that they are tailored to the specific savings goals of

customers. These include policies for education, combined health and life

insurance and funeral expenses. Specific examples of recent product innovations

include policies for school fees, polices that pay sums in the event of severe

illness as well as death, those that cover funeral expenses and those that are

inflation-indexed.

Reduced vulnerability to shocks

Life insurance addresses the risk of

death, with the insured person often being the main earner. In sub-Saharan

Africa, the death of the main income earner has a lower probability (in any

given year) than other shocks but its impact is the most severe in terms of

loss of household income.

Such vulnerability has a high

suitability for private insurance because of the low probability but high loss

to individual households. Private sector life insurance is a good way of

managing such economic shocks, providing a method to stabilize households in

the event of a shock and optimize their welfare by reducing the risk aversion

that can adversely affect long-term economic decision- making.

Complementing public welfare provision

Patronage of Life insurance by the

middle class act as an important complement to public welfare provisions

because it enables households to manage shocks without recourse to public

funds.

Social security systems and life

insurance penetration are negatively correlated, thus suggesting that people

actively choose private insurance when public provision is absent.

This allows scarce resources for

public services to be focused on the neediest and most vulnerable households and,

over the long-term as the proportion of the population entering the middle

classes grows, gradually reduce the reliance on public welfare provision.

ACCELERATING

INSURANCE MARKET DEVELOPMENT IN THE WEST AFRICAN ZONE

Financial access, literacy and consumer protection

Consumer demand for insurance

products is a requirement for the long-term development of the life insurance

market. There is limited knowledge of life insurance products and a lack of

trust by consumers in financial institutions. Distribution channels are too

narrow and products are not always adequately tailored to domestic consumer

preferences. These factors undermine consumer demand for life insurance.

High levels of trust by customers in

life insurance providers are important to the take-up of products. This is

especially the case because assets are held in trust for customers over the

long- term. At the core of such trust is an established track record of sound

and reputable private and regulatory institutions.

However, there are immediate

initiatives that can be considered in the region to accelerate increases in

consumer demand. These include the following:

· Consumer protection legislation - such as in relation to

marketing, premium payments and claims - needs to be in place to ensure clients

are treated fairly and to set standards for private institutions. This is

particularly important for vulnerable clients, such as those with low levels of

financial literacy. Simpler but well-executed consumer protection may be

preferable to more sophisticated protection that is difficult to implement in

the current sub-Saharan African context. More sophisticated protection can then

be gradually introduced as markets and institutions develop.

· Financial access for life insurance can be increased.

The distribution channels like - agency and foreign and domestic institutional

partnerships - can rapidly expand financial access to life insurance. Such

methods could replicate the successes in Asia where this approach has

significantly expanded access to life insurance, including in Vietnam,

Indonesia and Malaysia.

· Mobile distribution has been widely used in sub-Saharan

Africa for financial services and has been highly successful in expanding

financial access. In life insurance terms, it is expected to be an important

complementary service to agent-based distribution. This is because investment

decisions at the start and during the period of the insurance contract require

personal service in order to select appropriate products for customers and to

ensure customers are properly informed about the nature of the product they are

buying. Such needs are best met through agency networks because they provide

face-to-face advice and ongoing customer service relationships. Mobile

platforms are expected to provide other services such as premium payments,

investment information and standardized processing and communication.

· Product innovation that offers life insurance products

that are tailored to the financial lives of customers in the West African zone

is required. Such innovation is best encouraged through competition between

private sector providers. Rapid approval of new products by regulators would

also assist in this, such as the use of 'fast track' approval processes.

· Financial literacy programs help to develop customer

knowledge and ensure customers choose suitable products. Such programs have

been successful in the region for other insurance products, including

agricultural and health programs. Further programs should be supported for life

insurance including through partnering with reputable private firms as part of

their business development.

PROSPECTS IN GHANA

Growth in

Ghana has been underpinned by

·

rising public awareness about insurance benefits

·

advancements in the regulatory framework

·

expansion of the middle class population

·

acceptance of mobile insurance products - micro

insurers collaborate with mobile networks to reduce transaction costs and make

products affordable to low-income buyers; made possible by factors such as;

government backing which meant coordination of different agencies; supportive

legislation; and insurance companies that were prepared to innovate in their

distribution, collection and payment methods;

·

bancassurance - more than 20 banks have already

been granted licences to offer bancassurance products

·

Group life insurance is about to be made

compulsory next year (2020)

In 2017, there

was a Total premium of 1.1 bn cedis for Life Assurance, out of a total premium

figure of 2.4 bn cedis. In 2018, the total insurance industry experienced a 21%

growth in the gross written premium, but the penetration rate reduced from

1.12% to 1%. This rate excludes Pension and Health Insurance which is not

regulated by the insurance regulator NIC. The reduction of the penetration rate

can is due to the rebasing of the economy (source: NIC 2018 Annual Report).

The Life

Sector grew by 8% from GH¢ 2.89 billion in 2017 to GH¢ 3.12 billion in 2018; while

the Non – life Sector grew by 28% to end 2018 at GH¢ 2.38 billion, from GH¢

1.86 billion in 2017.

Due to the

budding mobile insurance sector, a steady rise has been seen in the insurance

sales owing to the trust of the general public in the mobile operators. The

insurance industry is looking at forming alliances between the masses and the network

providers because the MNO have been and still the catalyst for the growth of

Micro insurance in the companies that are involved in its operations.

Also,

bancassurance is another booming business of the Insurance sector in Ghana. The

insurers and banks are actively teaming up in partnerships to offer a wide

range of competitive and innovative products. Bancassurance has always been

considered optimistic opportunity when it comes to helping the insurance

industry owing to customers’ trust in banks and their competitive marketing

strategies. A growing number of insurers and banks have joined forces to offer

policies through banking windows.

Another very

important part of this sector is Microinsurance which has received an increased

attention in the recent years. It has been considered as one of the most viable

‘alternative financial product’ that is delivered to the unserved and

underserved market and the most vulnerable and marginalised sector. The

affordability of MI products, ease of purchase and high speed of claim

settlement are among the positive considerations why MI is a viable business

line.

Mobile phone

penetration rate is over 100%. The growth experienced in microinsurance in the

country has been primarily driven by the use of mobile phones as a distribution

channel. The combination of a young, tech-savvy population offers a fertile

market to sell insurance. Online and Mobile phone offers a useful avenue to

distribute products.

The Life industry

depends on the economic growth as it is expected that the increased wealth

would trigger demand for life products. Products are typically centred on group

life covers. The Group Life Insurance is a wonderful opportunity to increase

insurance penetration in Ghana, mainly because a single employer can purchase a

policy cover for a number of employees.

Opportunities

Technology

Technology has

already made significant impact on the Ghanaian insurance industry. The advent

of mobile phone as a distribution channel has helped greatly in the uptake of

microinsurance. However, there are a number of other emerging technologies that

will further change the manner by which insurance is transacted in Ghana. Some

of these emerging technologies are Artificial

Intelligence, Big Data, Internet of

Things, Cloud

Computing and Block Chain.

The research

and development activities of industry should consider how it can use these

emerging technologies to reduce cost and provide better coverage and services

to policyholders.

Recapitalisation

There were 24

Life Assurance Companies as of 2018. This figure may reduce when the New Minimum Capital

requirement takes effect in June 2021. The objective of the new MCR is to

improve the financial capacity and liquidity.

Table 1.1 Previous and new Minimum Capital

Requirements for different regulated entities

Entity

|

Previous MCR

|

New MCR

|

Insurance companies (Life & Non-Life)

|

GH¢ 15 million

|

GH¢ 50 million

|

Reinsurance companies

|

GH¢ 40 million

|

GH¢ 125 million

|

Insurance Broking companies

Loss Adjusters

|

GH¢ 300,000

|

GH¢ 500,000

|

Reinsurance Broking companies

|

GH¢ 1 million

|

GH¢ 1 million

|

GAMBIA

The Gambia’s

insurance industry comprises 11 insurance companies. Nine (9) of the

insurance companies including a Takaful/Islamic operator are general insurers

(operating in non-life), The wo Life companies operating in The Gambia are

foreign owned.

NIGERIA

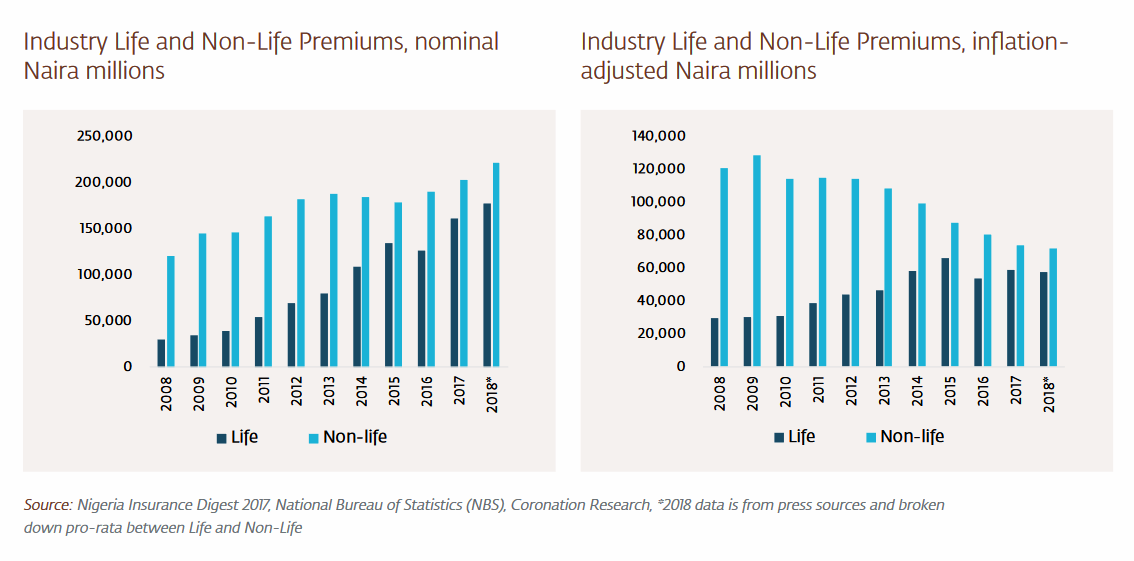

The Nigerian

insurance industry lags far behind the country’s other financial industries. The

insurance penetration for 2018 was a paltry 0.31%. In real terms, total

industry Non-Life Gross Premiums declined at a 10-year compound average growth

rate (CAGR) of 5.0% 2008-18e, while Life Gross Premiums grew at a 10-year CAGR

of 7.0% over the same period. The growth in the Life business has depended on

the emergence of mandatory Group Life policies for employers in the formal

sector. The total 2018 insurance premiums are reported at N400bn (US$1.1b) as

compared to nominal GDP of N129.1 trn.

Taking the

total Gross Premiums of Nigeria's Non-Life and Life insurance industries

together, these fell at an inflation-adjusted 10-year CAGR of 1.4% 2008-18.

New Minimum

Capital Regulation

There are

currently 59 insurance firms operating in Nigeria, but this number may reduce

by June 2020 when the new minimum capital requirement regulation takes effect.

Table 1.2

Class of business

|

Existing Capital Requirement

|

New Capital Requirement

|

Composite Insurers

|

5 billion naira

|

18 billion naira

|

Non-Life Insurers

|

3 billion naira

|

10 billion naira

|

Life Insurers

|

2 billion naira

|

8 billion naira

|

Source: Nigeria’s National Insurance Commission

(NAICOM); Recent naira/ US dollar exchange rate is N360/US$1, So N10bn is

US$27.8m, for example.

The new

minimum capital regulation, as can be seen from the Table 1.2 above, sets a

challenging deadline for the industry with significant implications for

mergers, acquisitions and capital raising. However, higher capitalisation

increases underwriting capacity and the potential exists to roll-out a much

bigger industry than currently exists. As stated, Nigeria’s insurance

penetration, at 0.31%, is less than one tenth of that of India (with similar

GDP per capita) which suggests significant un-tapped potential.

Experience

from other markets, particularly in Asia, suggest three remedies. First,

government and regulators – not only insurance regulators but bank and telecom regulators,

– need to cooperate. Second, the roll-out of micro-insurance with the development

aim of financial inclusion, is key to familiarising and educating the market.

Third, technology plays a key role in partnerships and distribution.

One phenomenon

which augurs wells for the future rapid growth of the industry is the fact that

the same companies which have enjoyed success in Asia, and rate the region as

their key growth zone, are also investors in Nigeria. Axa bought Mansard

Insurance in 2014 and Allianz bought Ensure in 2018; they are among six global

insurance companies, including Prudential of the UK, present in Nigeria.

Economies

of scale are needed

It is not

surprising that the Nigerian insurance industry lacks profitability. One effect

of lack of growth is that companies are unable to create economies of scale for

their front and back office operations. When growth opportunities arrived, the

Life Insurers made the mistake of computing their premiums down to

unsustainable levels in the rush to increase customer numbers, prompting the

regulator to intervene with a new minimum premium level in 2018.

While lack of

growth leads to excessive costs, low profitability creates another problem,

namely lack of investment in technology. Without the prospect of a much larger

customer base it may be difficult to persuade companies to invest. NAICOM’s

reforms, therefore, are very significant, as the industry is being forced to

raise capital.

Looking to

micro-insurance

The definition

of microinsurance is essentially the same as that of regular insurance, except

for the target market: low-income people. Rolling out micro-insurance products

as a matter of national policy has created mass awareness of insurance in other

countries. Mass awareness has been associated with expansion of the insurance

industry as a whole and rising insurance penetration. Such policies have been

implemented successfully in many countries, notably India and Ghana.

The

technology already exists

The

distribution channels for rolling out insurance in Nigeria are already in place,

but perhaps, grossly underemployed. In recent years the issuing of bank

verification numbers (BVN) and SIM card registration have created significant

levels of personal data. The technological platforms and the customer data

exist to service tens of millions.

Potential

Demographic Threat

Over 40% of Nigerians

are below 15 years, as compared to a global proportion of 26%. This, combined

with a rising unemployment rate, means there is a high dependency on the

working population which obviously affects savings. With a low ratio of working

population to non-working population (who are recipients of social

benefits), there is reduction in tax revenue

and increased spending on social benefits which affect the ability of the

middle class (about 20% of the population) to invest in life insurance.

LIBERIA

New Capital Requirements for Liberian

Insurance Companies

The Central Bank of Liberia (CBL) says that the

ongoing implementation of the capital requirements for all licensed insurance

companies operating in Liberia remains on course in line with regulation issued

in 2015 and amended in 2016.

The regulation sets the capital requirement for

each class of insurance business, and requires each insurance company to

maintain a minimum capital requirement based on the category of insurance

activity being undertaken by a company.

Table 1.3

Class of Business |

Reviewed Minimum Paid-Up Share Capital

|

Life Insurance Business

|

$750,000

|

General Insurance Business

|

$1.5 million

|

Reinsurance Business

|

$5 million

|

The implementation of the regulation, which began

September 30, 2016, is being executed in stages, on a quarterly basis, over a

period of three years to allow for flexibility. The recapitalization should

have taken effect in April 2019 but due to circumstances only known to the

government it did not come on

Conclusion

Life insurance

has the potential to both mobilize

domestic savings and investment and to create employment and enhance

household welfare, thereby

helping to drive economic growth

and development at a crucial

time in sub-Saharan Africa.

|

| Dr. Aaron Issa Anafure is the author of this article. He is the Chief Executive Officer of Quality Life Assurance Company (QLAC) Ghana |

Comments

Post a Comment